eTDS statement for 2013-14 first quarter is to be filed on or before July 15, 2013. Few important changes and points to remember are given below:

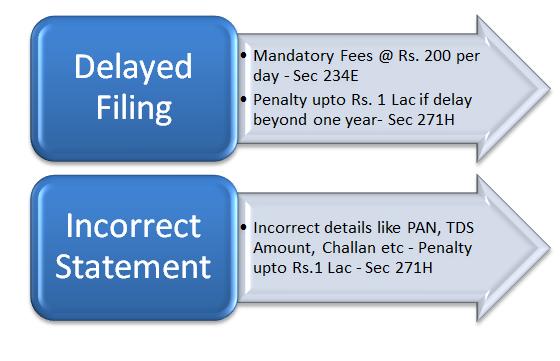

Mandatory Fees and Penal provisions

File eTDS Statement in time or pay late filing fees ( Section 234E)

failure to submit eTDS statement in time will result in fees

- A mandatory fees of Rs. 200 per day is applicable for any delay in furnishing of eTDS statement.

- Total fees will be limited to the amount of TDS deducted

- Such fees must be paid before filing of eTDS statement and shown appropriately therein.

Penalty for late filing or incorrect filing ( Section 271H)

- A delay beyond one year will result in penalty ranging from Rs. 10,000 to 1 lac.

- Failure to file eTDS statement or filing incorrect details like PAN, challan details, TDS amount will also result in penalty being levied ranging from Rs. 10,000 to 1 lac

From the above, it is clear that this time when you fie eTDS statement, you need to file in time and also ensure that you are not filing incorrect details in the statement.

No comments:

Post a Comment